Ajit Pawar tables Special Amnesty Scheme Bill for public sector enterprises

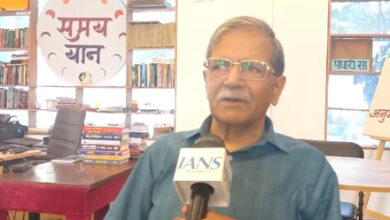

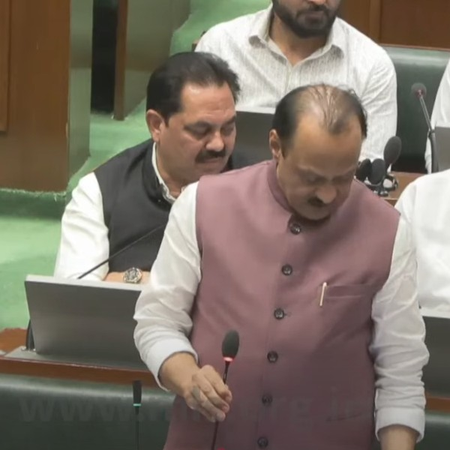

Mumbai, March 20 (IANS) Deputy Chief Minister and Finance Minister Ajit Pawar on Thursday tabled the ‘Maharashtra Tax, Interest, Penalty, or Late Fee (Settlement of Arrears Payable by Public Sector Undertakings) Bill, 2025’ in the Legislative Assembly.

Through this Bill, the government has introduced a special amnesty scheme for public sector enterprises.

Currently, public sector enterprises of the central and state governments have outstanding arrears amounting to approximately Rs 25,000 crore.

The scheme will help increase the efficiency in settling outstanding dues, ensuring that pending revenues are deposited in the state treasury, thereby making funds available for developmental projects.

Ajit Pawar had made announcement about the amnesty scheme while presenting the annual budget for 2025-26. The bill aims to provide relief to public sector enterprises of both the central and state governments.

The scheme will cover various taxes that were implemented by the state tax department before the introduction of the Goods and Services Tax (GST).

To facilitate recovery, Pawar said the government has decided to offer special concessions. The settlement scheme will be applicable from the date the bill is enacted until December 31, 2025.

Arrears from the period April 1, 2005, to June 30, 2017, will be eligible for this scheme. However, no concessions will be granted for undisputed taxes, and payment of 100 per cent of such dues will be mandatory.

Ajit Pawar also stated that the scheme will be implemented transparently through an online process.

Earlier, the state government tabled the Bill to amend the Maharashtra Stamps Act, 1958.

This was necessitated after the Deputy Chief Minister and Finance Minister Ajit Pawar in his budget for 2025-26 had proposed to mobilise additional revenue by revising stamp duty charged on certain documents.

“Section 4 of the Stamp Act is proposed to be amended with a. IRS to increase rate of stamp duty, which is fixed long ago at the nominal amount of Rs 100 to Rs 500 in case of supplementary document if more than one document is used to complete the transaction,” reads the bill.

“Sections 10 and 10D of the Stamp Act are proposed to be amended with a view to facilitate online mode for payment (e-payment) and “certificate of stamp duty” in State Government Treasury a new provision for “ e-stamp certificate,” so that people can pay stamp duty online at anytime from anywhere,” reads the bill.

Further, the bill says, “Sub section (1) of section 31 of the Stamp Act is proposed to be amended with a view to increase the adjudication fee from Rs 100 to Rs 1,000 for chargeability of the instrument, applying to have the opinion of the Collector and to provide for depositing the certain amount of stamp duty specified therein while filing application for adjudication of executed instrument.”

–IANS

sj/pgh